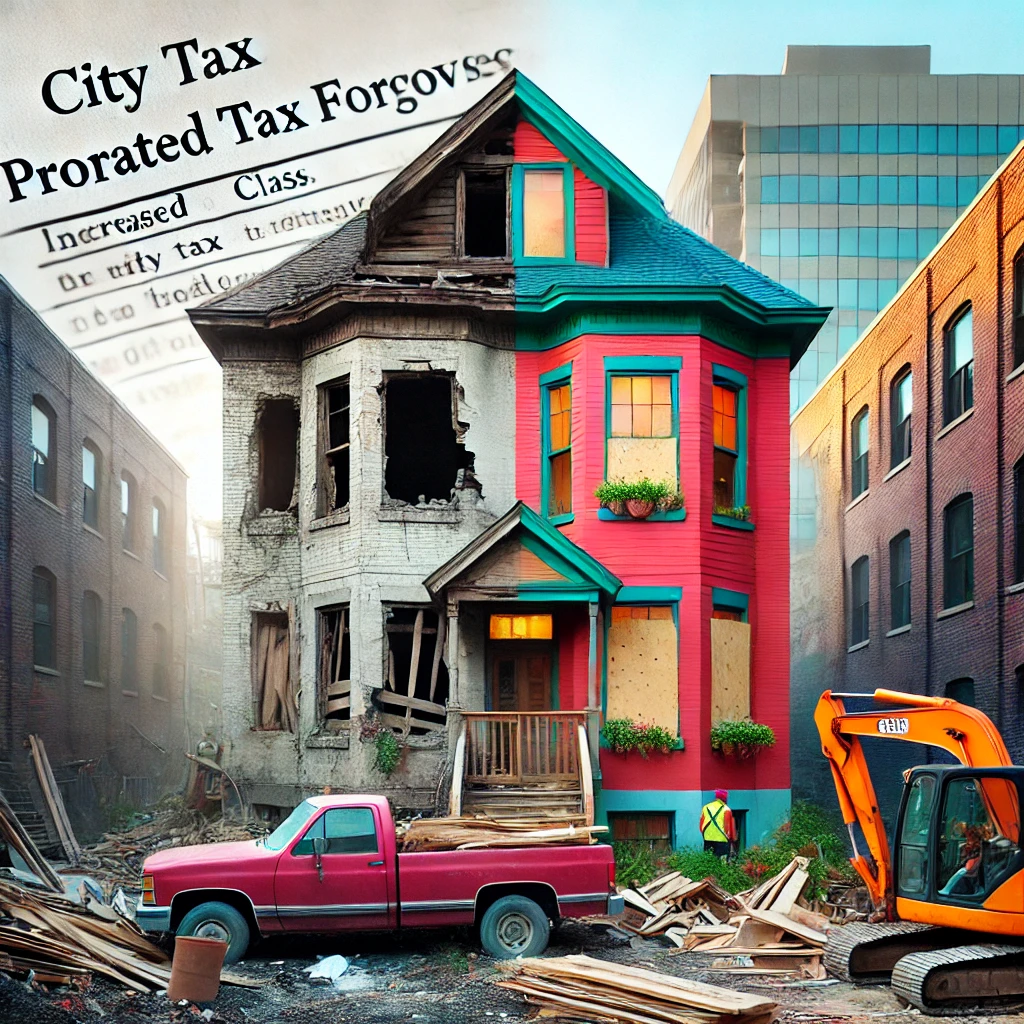

Edmonton’s New Approach to Revitalizing Derelict Properties: Prorated Tax Forgiveness and a Steeper Tax Class

- In an effort to combat the growing issue of neglected properties, the City of Edmonton is launching a prorated tax forgiveness program, designed to motivate property owners to either rehabilitate or redevelop rundown homes. This new initiative includes the introduction of a unique tax subclass, applying a rate nearly three times higher than the regular property tax on derelict properties in Edmonton’s established neighborhoods.

- This policy, effective immediately, allows owners who restore their properties in 2024 to apply for a reimbursement on any additional taxes paid. Starting this year, derelict property owners will receive details on the tax forgiveness application process with their annual notices, as assessments continue for the upcoming 2025 tax cycle.

- A Flexible Tax Forgiveness Program to Promote Swift Action

- Edmonton’s prorated tax forgiveness program offers an incentive structure encouraging property owners to bring derelict properties up to minimum standards throughout the year. Initially, owners are taxed at the higher derelict rate, but once improvements meet city standards, they can apply for a refund covering the period of compliance. This prorated approach is designed to prompt timely clean-ups, pushing owners to either rehabilitate or demolish dilapidated structures rather than allowing them to fall into further disrepair.

- For property owners who complete improvements, the tax rate shifts from the higher derelict rate back to the general residential rate for the remainder of the year—rewarding prompt and meaningful efforts to restore neglected spaces.

- Introducing Edmonton’s Derelict Property Tax Subclass

- Beginning in 2024, Edmonton’s new derelict residential subclass enables the city to impose higher tax rates on properties deemed uninhabitable, severely deteriorated, or neglected in mature neighborhoods. By increasing taxes on these properties, the city aims to motivate owners to address the condition of their buildings—whether through upgrades or redevelopment. Beyond aesthetics, this measure targets improved safety and resource management, as the city looks to reduce the strain on municipal resources spent on inspections and enforcement for unsafe properties.

- Previously, the city spent over $1.3 million between 2017 and 2020 on bylaw enforcement and health and safety checks for just 31 properties. Edmonton’s leaders hope that this tax subclass, paired with the forgiveness program, will relieve some of these financial pressures by incentivizing quicker remediation.

- Positive Changes Seen in Early Program Results

- Initial outcomes from the derelict subclass program suggest meaningful progress. This year alone, more than 200 properties have been identified as derelict, with 23 already undergoing demolition. Beyond improving neighborhood safety and reducing fire risk, the program is showing tangible quality-of-life enhancements for residents as derelict sites are cleared and transformed.

- The Edmonton City Council plans to release a detailed report in early 2025, highlighting the program’s impact on the community and evaluating its effectiveness in promoting safe, appealing neighborhoods.